For successful growth, every good company needs access to meaningful data about its own financial situation. This is the only way to ensure easily plannable liquidity. Regrettably, a large number of promising e-commerce companies do not have access to insightful financial data or sufficient readily available capital.

fulfin provides a remedy for both problems

Already successfully financing e-commerce merchants since 2018, fulfin has gained access to the financial data of countless companies as part of thousands of financing applications. This data, anonymized in accordance with data protection laws, forms the basis for the Financial Health Index – an analysis tool that reliably compares the financial KPIs of existing customers with those of potential new customers. The comparison of the performance data results in a valid scoring from A to D, which is an essential part of the fulfin risk assessment. By using this information, Fulfin enables e-commerce companies to benchmark their own financial performance against the most relevant peer group.

Four KPIs form the benchmarking framework

fulfin’s implemented AI-assisted algorithms tested a variety of different financial metrics and identified four key metrics as particularly meaningful. The following key figures allow us to make a reliable forecast about the current and future financial strength of an e-commerce company.

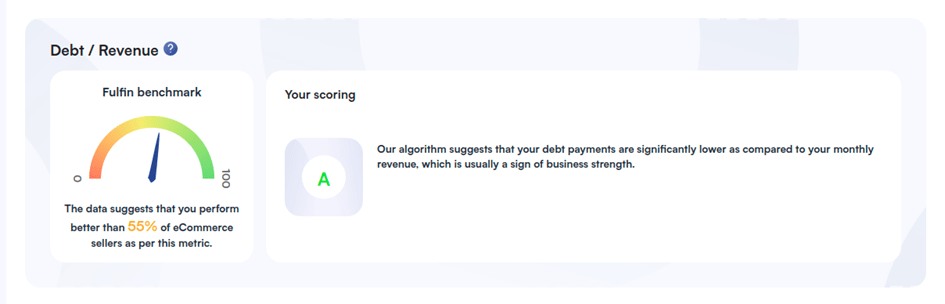

1. debt / sales

The ratio of existing debt to real sales shows whether an e-commerce company is disproportionately indebted. For example, due to the highly seasonal volatility of earnings in online retail, the ability to service existing liabilities must be planned even better than in companies with more predictable earnings. An existing or potential discrepancy between debt and revenue is identified using this KPI.

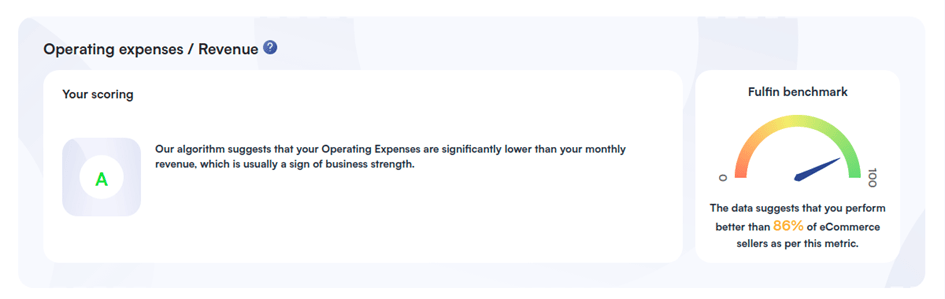

2. fixed costs / sales

The share of existing operating costs in generated sales reveals in benchmarking whether the company’s own fixed costs are to be considered too high. Excessively high fixed costs inevitably lead to a reduction in liquidity and a possible payment default in the event of a decline in production or sales.

Our data analysis indicates that a majority of e-commerce businesses have operating costs between 10% and 40% of their revenue, depending on how efficiently they are run. The median here is 25%.

E-commerce companies with optimized operating expenses relative to revenue are more resilient and also able to scale faster than their inefficient competitors.

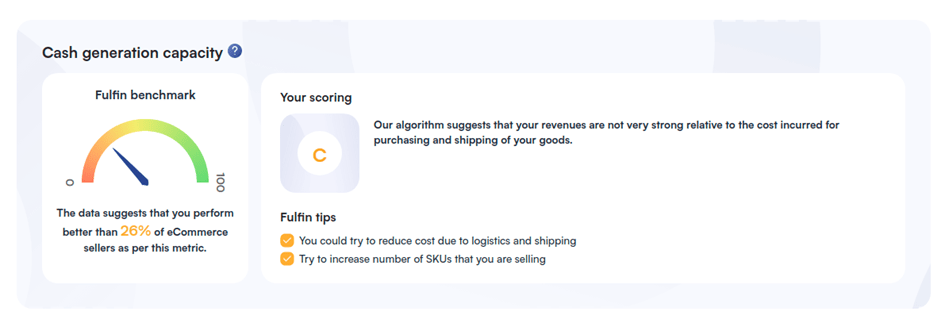

3. profitability

Data-based algorithms are used to evaluate sales and existing acquisition and logistics costs. Profitability scoring thus provides information on whether an e-commerce company is setting a sufficient margin for the items managed in its existing product range and is thus operating profitably overall.

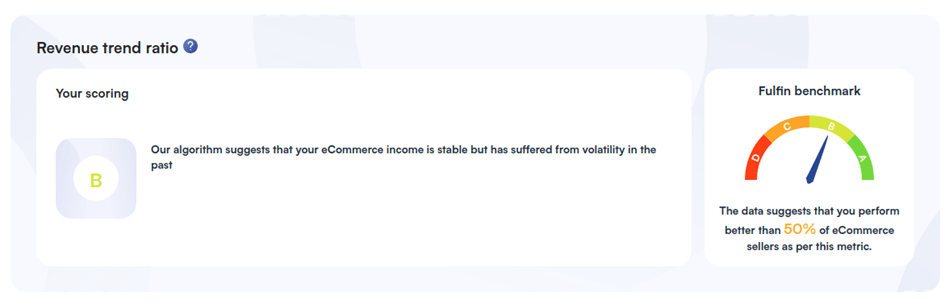

4. Revenue stability

This KPI indicates whether there is relatively low or high volatility in sales by evaluating the sales trend. Fluctuating sales, for example due to seasonal effects, therefore mean that no reliable cash flow can be guaranteed. Successful e-commerce businesses know how critical it is to mitigate existing seasonality with off-season promotions and special offers to drive sales. Companies that master this have more constant revenues and can therefore better manage the repayment of their liabilities.

Data versus insights – a win-win situation

The financial data and economic insights of thousands of German online retailers enable us to set up a reliable financial rating with the Financial Health Index, which is 100% tailored to the requirements of e-commerce companies. These insights enable us to provide customers with a suitable credit offer at exactly the right moment, allowing them to successfully scale their business.

As a further fundamental added value, our new financial rating offers customers a deep insight into the financial situation of their company. Based on this, we also provide tips on how to improve current financial performance.

fulfin’s Financial Health Index is thus a true digital gamechanger, enabling an unprecedented win-win situation for borrowers and lenders.