Smart financing for your online business

Beschleunige Dein Wachstum mit schnellen Finanzierungen und wertvollen Insights für E-Commerce-Händler und digitale Unternehmer.

Beschleunige Dein Wachstum mit schnellen Finanzierungen und wertvollen Insights für E-Commerce-Händler und digitale Unternehmer.

Supercharge your growth with fast financing and invaluable insights tailored for E-commerce merchants and digital entrepreneurs.

In wenigen Minuten Antrag ausfüllen & innerhalb von 24 Stunden Zusage erhalten.

Vollständig digitaler Prozess für reibungslos einfache Antragsstellung.

Höchste Datensicherheit dank bewährter, datenschutzkonformer Partner.

Wir verstehen, wie Dein Unternehmen funktioniert und können Dir deshalb die für Dich passende schnelle, faire und flexible Finanzierung mit transparenter Preisgestaltung anbieten.

Los geht es bereits ab 0,99% pro Monat.

Darüber hinaus stellen wir Dir Daten zur Verfügung, die Dir zeigen, wie Du im Vergleich zum performst.

Details zu Deinem Unternehmen teilen &

ein vorläufiges Angebot erhalten.

Unternehmenskonto verbinden & innerhalb von 48 Stunden eine Finanzierung sichern.

Rückzahlung in einfachen wöchentlichen oder monatlichen Raten

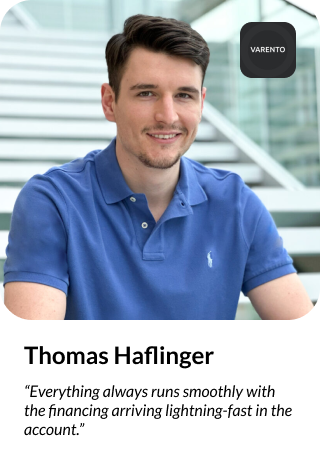

Thomas Halfinger

@HOMEVICTORY

Schnelles Geld für Wachstum

”Arbeite schon seit über 2 Jahren mit Fulfin und es läuft immer alles Reibungslos ab und die Finanzierungen sind nach ein paar Tagen schon auf dem Konto. Blitzschnell.

Der Support ist auch mega zuvorkommend und Hilfreich. Immer gut erreichbar.

Kann ich jedem sehr empfehlen!.”

Bewertung: 5 von 5 - bei über 140 Bewertungen

Piotr S.

@Atello

Einfach, schnell und flexibel

“Sehr schnelle und unkomplizierte Abwicklung (ca. 1 Woche nach Antragsstellung die Auszahlung erhalten). Für den Bereich E-Commerce als Seller sehr geeignet.

Der telefonische Support ist auch sehr kompetent und bei Fragen immer zur Stelle.

Klare Empfehlung !!!”

Bewertung: 5 von 5 - bei über 140 Bewertungen

Erencan Pektas

@Elekjack

Sehr schnelle Abwicklung

“Alles verlief Reibungslos!

Mein Ansprechpartner war gefühlt jede Sekunde für unsere Anliegen da!

Kann ich nur Weiterempfehlen!”

Bewertung: 5 von 5 - bei über 140 Bewertungen

Rino Großmann

@bigman-e-commerce

Extrem schnelle Bearbeitung und Auszahlung

“Die Anfrage war innerhalb von Minuten erstellt.

Die Zusage und Auszahlung erfolge innerhalb von 5 Werktagen.

Schneller geht es wirklich nicht!!!”

Bewertung: 5 von 5 - bei über 140 Bewertungen

Martin Picard

@Störtebekker®

Super angenehme Zusammenarbeit

“Super angenehme Zusammenarbeit.

Der Prozess ist sehr geradlinig, das Geld ist schnell auf dem Konto.

Immer gerne wieder!”

Bewertung: 5 von 5 - bei über 140 Bewertungen

LEDEON Concept UG

@LEDeon

Empfehlenswert!

"Saubere, individuelle Abwicklung.

Schnelle Auszahlung.

Empfehlenswert!”

Bewertung: 5 von 5 - bei über 140 Bewertungen

"An fulfin hat mir besonders der digitale Prozess gefallen. Das Darlehen wurde sehr schnell genehmigt ohne langes hin und her, dass man von anderen Kreditgebern kennt. Die Konditionen sind weitaus besser als bei sämtlichen Banken."

Enrico Scheele - Geschäftsführer, KnsWarehouse

Wir helfen Dir gerne weiter!

Du erreichst uns telefonisch von Montag bis Freitag zwischen 09:00 und 17:00 Uhr oder rund um die Uhr per E-Mail.

Hier haben wir einige der häufigsten Fragen und die passenden Antworten zusammengestellt.

Weitere Fragen und Antworten findest Du in unseren ausführlichen FAQ.

Unsere Gebühren werden als Prozentsatz des Darlehensbetrags berechnet und beginnen bereits bei einem festen Satz von 0,7% pro Monat.

Die Höhe der Gebühren hängt von verschiedenen Faktoren ab, wie zum Beispiel der Darlehenssumme, der Anzahl der Raten und der Dauer von möglichen Zahlungspausen.

Die von fulfin vergebenen Wachstumsfinanzierungen liegen zwischen 10.000 € bis 500.000 €.

Als Faustformel lässt sich sagen, dass die Höhe der bewilligten Finanzierungen in der Regel ca. 10-25 % des Jahresumsatzes beträgt.

Wenn dein Unternehmen wächst, sich dein Jahresumsatz also erhöht, erhöhen wir selbstverständlich auch die mögliche Darlehenshöhe.

Die Höhe der möglichen Wachstumsfinanzierung hängt von vielen verschiedenen Faktoren ab und steht erst nach erfolgter Risikoprüfung exakt fest.

Je schneller die benötigten Unterlagen zur Verfügung stehen, desto schneller können wir ein Angebot abgeben.

Das Ausfüllen des Antrages dauert durchschnittlich 4 Minuten.

Nachdem wir alle Unterlagen komplett erhalten haben, können wir nach der Risikoprüfung innerhalb von 24 Stunden ein Angebot machen.

Nach Abklärung der Rückzahlungsmodalitäten schicken wir dir den Vertrag.

Sobald der Vertrag unterschrieben ist, kann innerhalb von 24 Stunden der Darlehensbetrag ausgezahlt werden.

Im Durchschnitt dauert der gesamte Prozess von der Beantragung bis zur Auszahlung des Darlehens etwa vier Arbeitstage.

Unser Rekord liegt allerdings bei 6,5 Stunden.

Stelle einen Antrag und lass uns diesen Rekord brechen. 😉

Die Anmeldung in unserer App und die Bearbeitung deines Antrags sind vollkommen kostenlos und unverbindlich.

Falls wir dir ein Darlehensangebot unterbreiten, hast du 30 Tage Zeit, um zu entscheiden, ob du es annehmen möchten.

Es ist zudem problemlos möglich, die Höhe der Kreditsumme zu reduzieren und die Laufzeit anzupassen.